White Label Trading Software Programs’ Advantages

- Cost-effective: Building a forex trading platform from the ground up requires a sizable investment of time, money, and knowledge. White-label forex solutions let businesses use well-known platforms without making significant initial investments.

- Quick Market Entry: Companies can quickly introduce their Forex services to the general public because the platform has already been developed.

- Branding: Businesses can easily alter and brand the platform, ensuring that it is consistent with their corporate identity.

- Technical Support: The majority of white label vendors provide technical support, making sure that any issues are resolved right away.

- White label platforms are regularly updated to include the newest features and tools as the Forex market develops.

Price of a White Label Forex Trading Platform

A white-label Forex trading platform’s cost can vary significantly depending on the features it offers, the provider’s standing, and the degree of customization needed. There are primarily two cost structures:

- Initial Setup Fee: This is a one-time cost for setting up the platform that is paid to the white-label provider. Can start from 5000USD to 30000USD, depending on many factors.

- A recurring monthly fee that goes toward platform upkeep, updates, and technical support. Can start from 500USD to 10000USD

- Businesses can easily launch their own trading platform with MT4 & MT5 Broker White Label Solutions. These solutions are ideal for firms looking to enter forex trading without the high costs and complexity of building a platform. MT4 & MT5 White Label Solutions allow businesses to offer their clients a proven trading interface with their own branding and robust backend infrastructure and support. This boosts credibility and speeds up market entry.

Which White Label Brokerage Platform to Use

The following things should be taken into account when selecting a white label brokerage platform:

- Features and functionality: Check to see if the platform has all the features and tools you’ll need to run your business.

- Customizability: The platform needs to be able to be changed to fit your branding and business needs.

- Reliability: The platform should have a history of uptime and dependability.

- Technical Support: To get prompt resolution of any issues, choose providers with strong technical support.

- Cost: As was already mentioned, when assessing the price of a white label solution, take into account both the initial setup fee and the monthly fee.

FAQs

A white label trading platform: What is it?

A white label trading platform enables businesses to provide trading services under their own brand without having to create a platform from scratch. It is a ready-made solution created by one company but rebranded and sold by another.

Why should companies choose white label trading software?

White label solutions are affordable, allow for quick market entry, offer opportunities for branding, include technical support, and are frequently updated.

What is the price of a white-label Forex trading platform?

Depending on the provider and features, prices may change. Businesses typically pay a one-time setup fee and a monthly fee. Around 50000USD

Can a white label brokerage platform be modified to suit my company’s needs?

Yes, the majority of white label solutions provide customization options to match your branding and operational needs.

White label forex platforms: Are they dependable?

The majority of reputable white label vendors make sure their platforms are dependable and offer strong technical support. But it’s crucial to do your homework and pick a dependable provider.

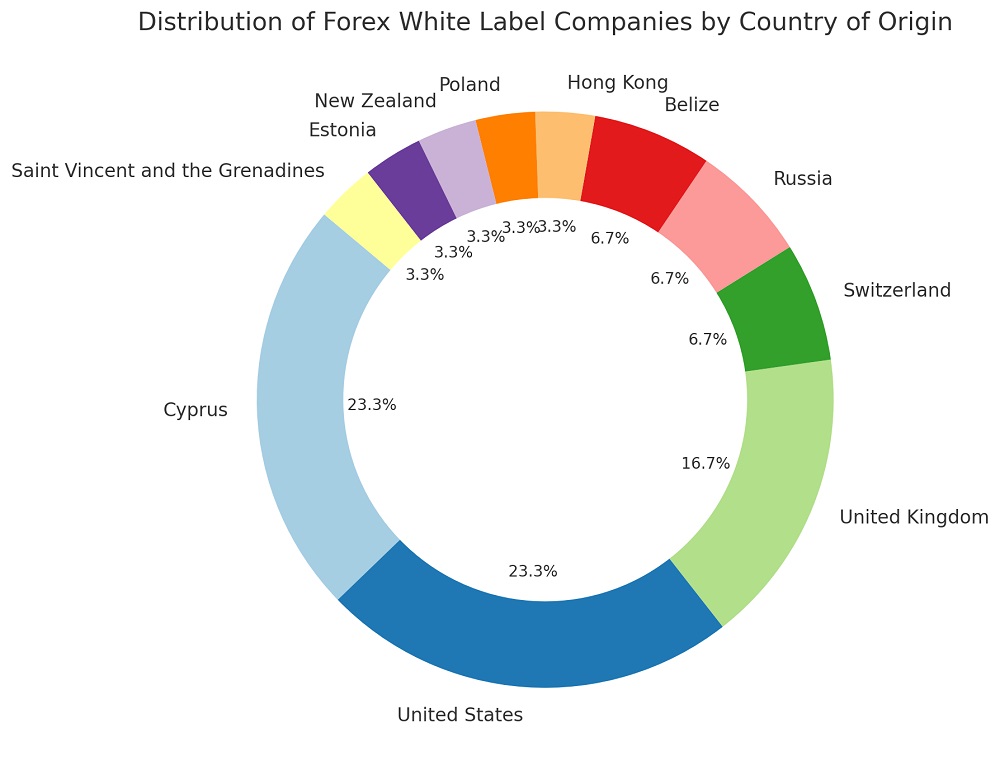

What are the most popular Forex licenses in the market?

A regulatory approval that enables businesses to engage in foreign exchange trading is known as a forex license. It’s a crucial certification for forex businesses, ensuring that they operate within the bounds of global financial regulations and uphold the confidence of their customers. The license is evidence of the business’s moral character, financial soundness, and dedication to fostering an open trading environment. The Comoros forex license stands out as a popular option among many forex establishments, offering a blend of credibility and ease of acquisition, despite the fact that many licenses are recognized globally.

Businesses can successfully access the Forex market and provide top-notch trading services to their clients by integrating the best white label trading platform solutions. To make an informed choice, it’s critical to comprehend the advantages, disadvantages, and key characteristics of these platforms.