There are a few reasons why top banks are often considered to be the best 50 in the world 2023:

- Financial stability: Top banks tend to be more financially stable than smaller banks or financial institutions. This is because they have larger asset bases and a more diverse range of financial products and services, which can help to mitigate risks.

- Customer service: Top banks generally have a reputation for providing good customer service. This can include things like having a large network of branches and ATMs, as well as offering online and mobile banking services.

- Range of products and services: Top banks typically offer a wide range of financial products and services, including checking and savings accounts, loans, credit cards, investment products, and insurance. This can make it easier for customers to manage all of their financial needs in one place.

- Convenience: Many top banks have a strong online presence, which makes it easy for customers to access their accounts and perform financial transactions from anywhere.

Overall, top banks tend to be well-regarded because they offer a combination of financial stability, good customer service, a wide range of products and services, and convenience.

It is difficult to determine the “best” banks in the world, as different banks excel in different areas and may be the best option for different individuals or businesses. Some factors that could be considered when determining the best bank for a particular person or business include the bank’s financial stability, customer service, fees, convenience, and the range of products and services offered. It is also important to consider whether the bank aligns with your values and meets your specific financial needs.

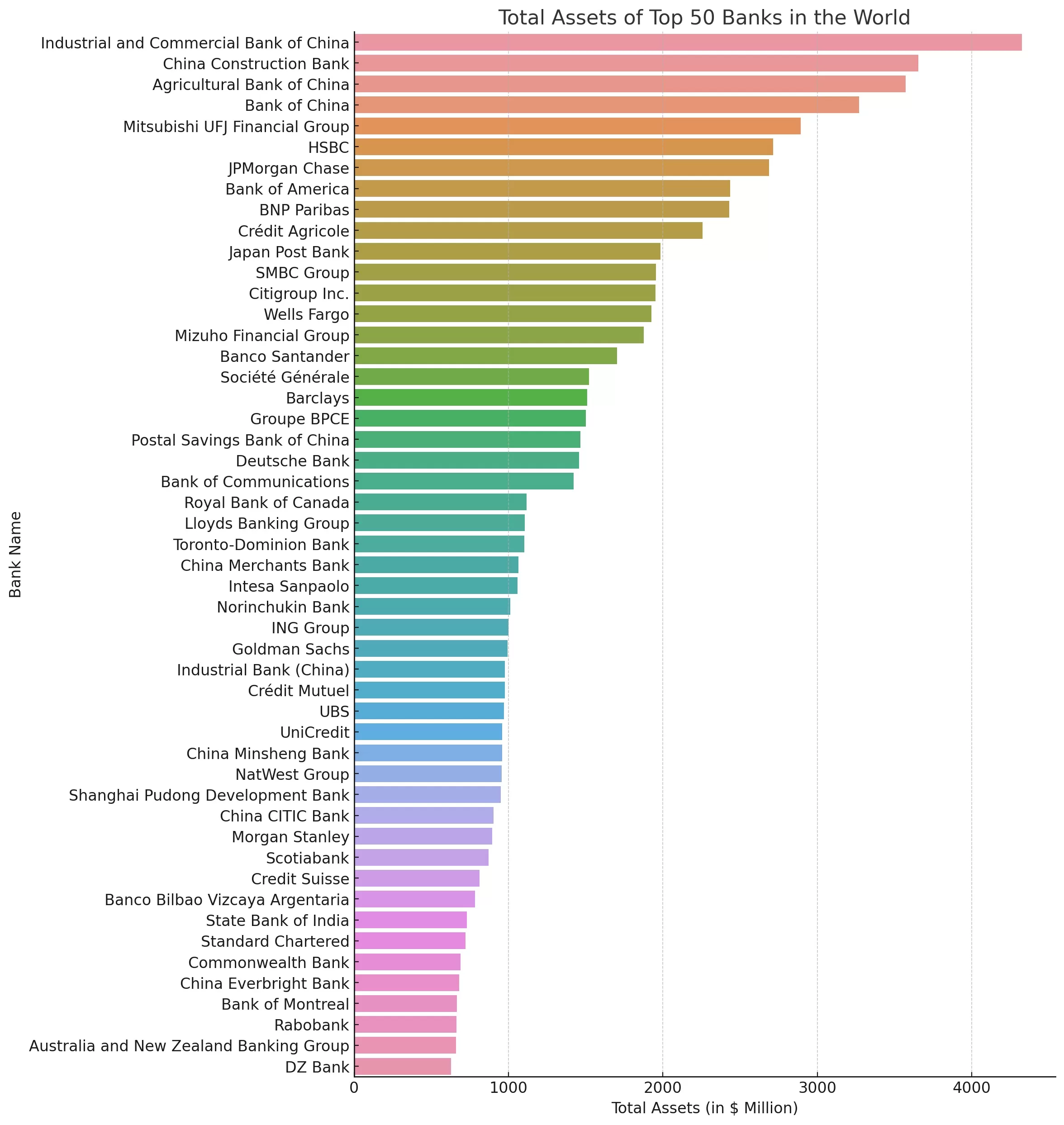

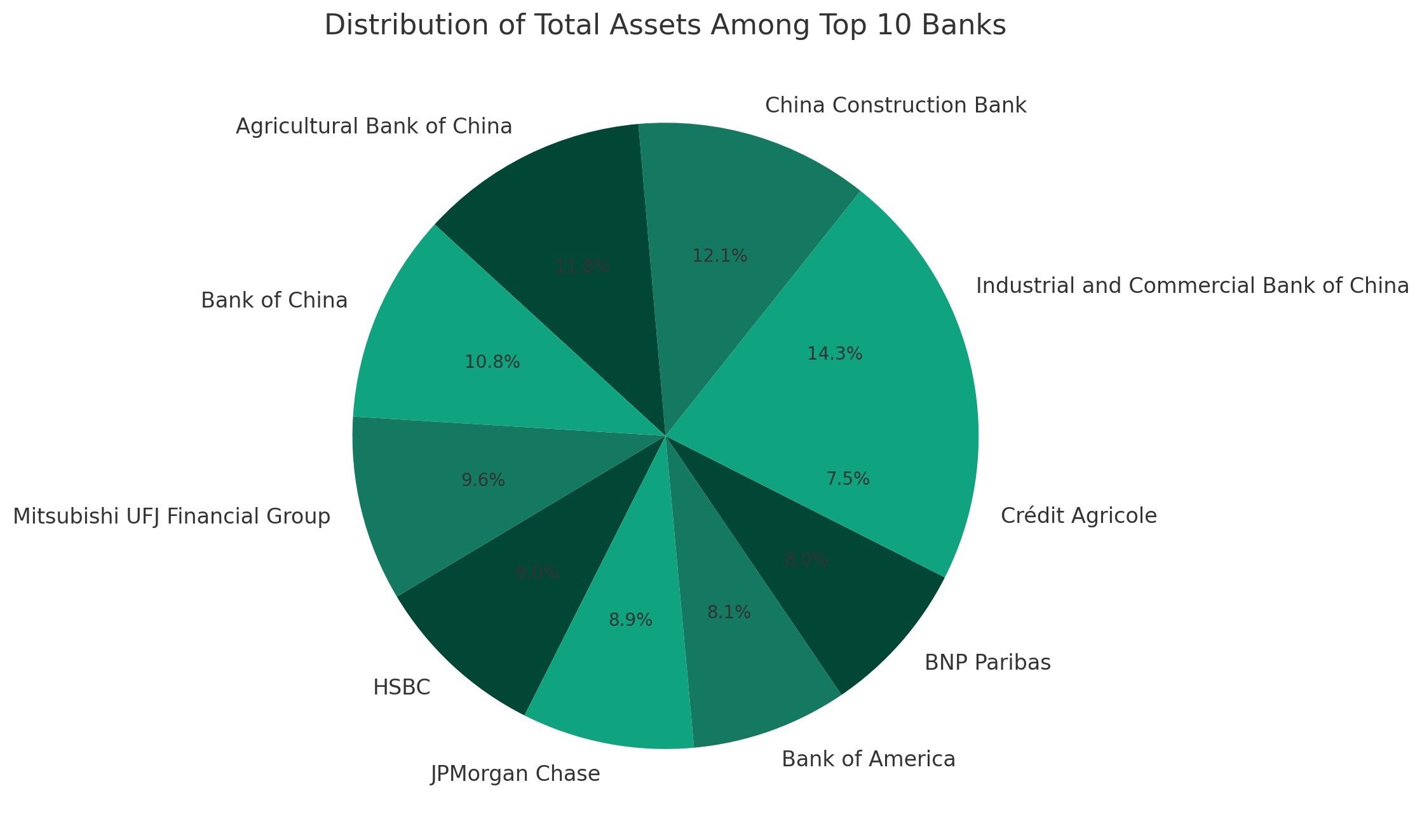

Some banks that are often considered to be among the top in the world include JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, and Goldman Sachs, which are all large, global banks with a strong presence in many countries. However, it is important to do your own research and consider the specific needs and priorities of your individual or business before choosing a bank

To measure how rich a bank is, analysts usually measure the bank’s net asset value, which means deducting outstanding debt and borrowing from the assets owned. In this method, the top 5 richest banks in the world, leaving off the same four Chinese banks, list three from Japan and one each from USA and France. This is largely because Japanese banks are highly structured and very conservative.

Before the start of the COVID-19 pandemic, there were indications that the world economy was going to grow by around 2.5%, and banks generally would be growing at that rate or slightly faster. However, the drastic effects of the pandemic have made it extremely unlikely that there will be any growth at all, and have also made it very difficult to predict which banks will survive the downgrading better than others.

The only way to attempt is to consider which countries were performing best, like Taiwan, Japan and Australia, compared to the worst affected, like most of Europe, USA, Brazil and Mexico. It is expected that the medium and long-term effects of the pandemic will show up over the next 18 months and share prices generally will show the results.

In one of the best analyses of the likely outcome of the pandemic on the top banks in the world, Forbes analysis Anton Guera has written a comprehensive report. His bottom line is that “Potential threats to all banks on the Forbes Global 2000 come from the looming crunch in business activity and spiking distress worldwide.”

Investment Banks

Investment banks operate in a special sector of the finance industry, offering management of client’s money rather than commercial activities. Due to the massive size of the US economy, all five of the top 5 investment banks in the world 2023 are American. If the rest of the world is ranked without the USA, then Switzerland with three is the largest followed by Japan, France, UK and Canada with two each.

Commercial Banks

Commercial banks offer private and corporate customers the full range of services, such as checking accounts, mortgages and loans, deposit accounts and so on. The top 5 commercial banks in North America include four in the USA and one Canadian. In Europe, the UK, Germany and France share the top 5 commercial banks for now, but Brexit may change this as several larger banks are considering moving into the EU from London.

Want to know more about the richest banks in the world? Click HERE