| 1 |

1 |

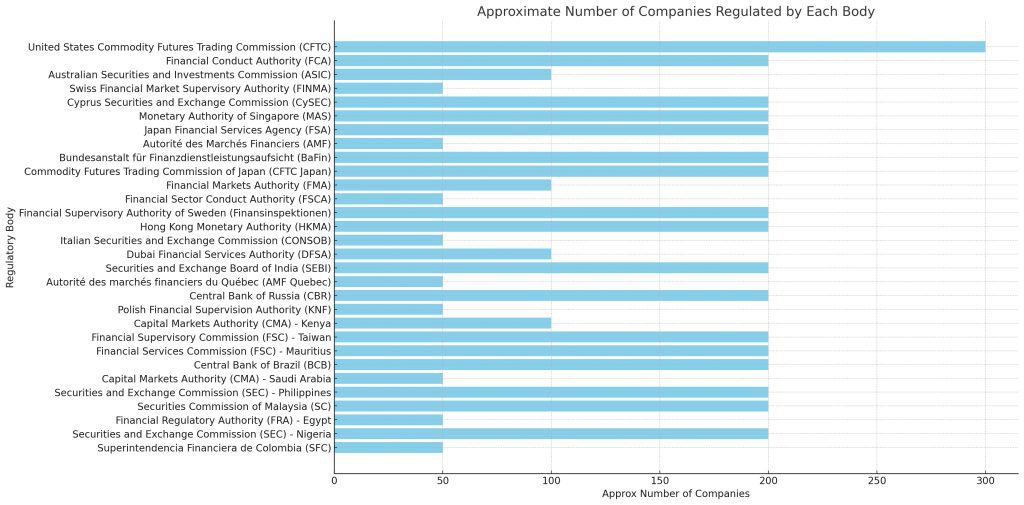

United States Commodity Futures Trading Commission (CFTC) |

Regulates futures and options markets in the U.S. for market integrity and trader protection. |

Hundreds of companies |

| 2 |

2 |

Financial Conduct Authority (FCA) |

UK regulator ensuring consumer protection, market integrity, and competition in financial services. |

Numerous companies |

| 3 |

3 |

Australian Securities and Investments Commission (ASIC) |

Regulates Australia's financial markets, including forex, for fair markets and investor protection. |

Several companies |

| 4 |

4 |

Swiss Financial Market Supervisory Authority (FINMA) |

Independent regulator for Switzerland's financial markets, ensuring stability and preventing financial crime. |

Various companies |

| 5 |

5 |

Cyprus Securities and Exchange Commission (CySEC) |

Regulates Cyprus' financial markets, including forex, for transparency and compliance with EU regulations. |

Numerous companies |

| 6 |

6 |

Monetary Authority of Singapore (MAS) |

Central bank and financial regulatory authority of Singapore, overseeing forex and financial activities. |

Numerous companies |

| 7 |

7 |

Japan Financial Services Agency (FSA) |

Regulator in Japan overseeing financial markets, including forex, to ensure stability and investor protection. |

Numerous companies |

| 8 |

8 |

Autorité des Marchés Financiers (AMF) |

French financial regulatory authority ensuring transparency, investor protection, and fair markets. |

Various companies |

| 9 |

9 |

Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) |

German federal financial supervisory authority regulating financial services, including forex trading. |

Numerous companies |

| 10 |

10 |

Commodity Futures Trading Commission of Japan (CFTC Japan) |

Japanese regulatory body overseeing commodity futures and forex markets for fair and transparent trading. |

Numerous companies |

| 11 |

11 |

Financial Markets Authority (FMA) |

New Zealand's regulatory authority for financial markets, including forex, focusing on investor protection. |

Several companies |

| 12 |

12 |

Financial Sector Conduct Authority (FSCA) |

South African regulator ensuring fair conduct and customer protection in the financial sector, including forex. |

Various companies |

| 13 |

13 |

Financial Supervisory Authority of Sweden (Finansinspektionen) |

Swedish authority regulating financial markets, including forex, for stability and consumer protection. |

Numerous companies |

| 14 |

14 |

Hong Kong Monetary Authority (HKMA) |

Hong Kong's central bank and financial regulator overseeing forex and monetary stability. |

Numerous companies |

| 15 |

15 |

Italian Securities and Exchange Commission (CONSOB) |

Italian regulatory authority for financial markets, including forex, ensuring transparency and investor protection. |

Various companies |

| 16 |

16 |

Dubai Financial Services Authority (DFSA) |

Regulator for financial services conducted in or from the Dubai International Financial Centre (DIFC). |

Several companies |

| 17 |

17 |

Securities and Exchange Board of India (SEBI) |

Indian regulatory authority overseeing securities and forex markets to ensure investor protection. |

Numerous companies |

| 18 |

18 |

Autorité des marchés financiers du Québec (AMF Quebec) |

Quebec's financial market regulator, ensuring transparency and compliance in forex and other financial activities. |

Various companies |

| 19 |

19 |

Central Bank of Russia (CBR) |

Russia's central bank and financial regulator overseeing forex and monetary policy. |

Numerous companies |

| 20 |

20 |

Polish Financial Supervision Authority (KNF) |

Regulatory authority in Poland ensuring stability and investor protection in financial markets, including forex. |

Various companies |

| 21 |

21 |

Capital Markets Authority (CMA) - Kenya |

Kenyan regulatory body overseeing capital markets, including forex trading, for investor protection. |

Several companies |

| 22 |

22 |

Financial Supervisory Commission (FSC) - Taiwan |

Regulatory authority in Taiwan overseeing financial markets, including forex, for market stability and integrity. |

Numerous companies |

| 23 |

23 |

Financial Services Commission (FSC) - Mauritius |

Regulatory authority in Mauritius ensuring transparency and investor protection in financial activities. |

Numerous companies |

| 24 |

24 |

Central Bank of Brazil (BCB) |

Brazil's central bank overseeing monetary policy and financial stability, including aspects of forex trading. |

Numerous companies |

| 25 |

25 |

Capital Markets Authority (CMA) - Saudi Arabia |

Saudi Arabian regulator for capital markets, including forex, aiming for transparency and investor confidence. |

Various companies |

| 26 |

26 |

Securities and Exchange Commission (SEC) - Philippines |

Philippine regulator for securities and forex markets, focusing on investor protection and market integrity. |

Numerous companies |

| 27 |

27 |

Securities Commission of Malaysia (SC) |

Malaysian regulatory authority overseeing securities and capital markets, including forex trading. |

Numerous companies |

| 28 |

28 |

Financial Regulatory Authority (FRA) - Egypt |

Egyptian regulatory body for non-banking financial markets, including forex, promoting stability and investor protection. |

Various companies |

| 29 |

29 |

Securities and Exchange Commission (SEC) - Nigeria |

Nigerian regulatory authority overseeing securities and capital markets, including forex trading. |

Numerous companies |

| 30 |

30 |

Superintendencia Financiera de Colombia (SFC) |

Colombian financial regulatory authority ensuring stability and transparency in financial markets, including forex. |

Various companies |